wake county nc sales tax breakdown

North Carolina state sales tax. Wake County sales tax.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

This rate includes any state county city and local sales taxes.

. Pay tax bills online file business listings and gross receipts sales. The average cumulative sales tax rate in Wake Forest North Carolina is 725. Apex is in the following zip codes.

3 rows Wake County NC Sales Tax Rate. To review the rules in North Carolina visit our state-by-state guide. Wake Forest is located within Wake County North Carolina.

The most populous county in North Carolina is Wake County. 22 rows The total sales tax rate in any given location can be broken down into state county city. Wake Forest NC Sales Tax Rate The current total local sales tax rate in Wake Forest NC.

If you need access to a database of all North Carolina local sales tax rates visit the sales tax data page. The County sales tax rate is. Within Wake Forest there are around 2 zip codes with the most populous zip code being 27587.

Search real estate and property tax bills. This includes the rates on the state county city and special levels. Learn about listing and appraisal methods appeals and tax relief.

Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under GS. 2020 rates included for use while preparing your income tax. Any municipal vehicle tax assessed in accordance with NC General Statute 20-97 is not subject to proration or refund.

View statistics parcel data and tax bill files. The County sales tax rate is. State Sales Tax and is remitted to the County on a monthly basis.

This takes into account the rates on the state level county level city level and special level. This is the total of state county and city sales tax rates. The North Carolina state sales tax rate is currently.

Ad New State Sales Tax Registration. As far as all counties go the place with the highest sales tax rate is Durham County and the place with the lowest sales tax rate is. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any.

This is the total of state and county sales tax rates. The Wake Crossroads sales tax rate is. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Wake County. What is the sales tax rate in Wake Forest North Carolina. Within Raleigh there are around 40 zip codes with the most populous zip code being 27610.

The North Carolina sales tax rate is currently. This tax is collected by the merchant in addition to NC. The 2018 United States Supreme Court decision in South Dakota v.

The minimum combined 2022 sales tax rate for Wake Crossroads North Carolina is. Sales Tax North Carolina information registration support. The average cumulative sales tax rate in Raleigh North Carolina is 725.

What is the sales tax rate in Wake Crossroads North Carolina. Sales Tax Breakdown. The Wake County sales tax rate is.

The North Carolina sales tax rate is currently. The most populous location. Apex Details Apex NC is in Wake County.

The sales tax rate does not vary based on zip code. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund. The Wake Forest sales tax rate is.

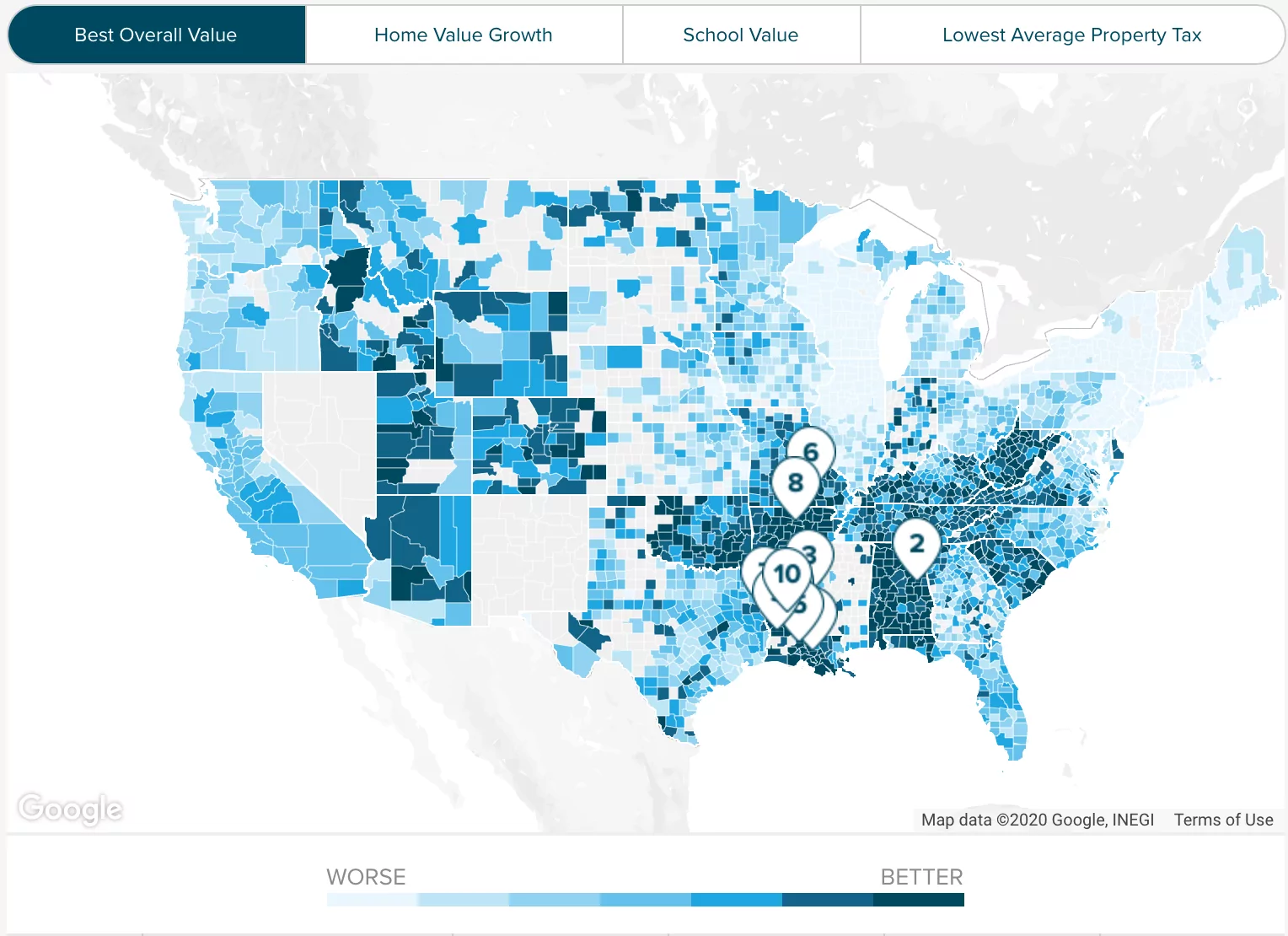

Click any locality for a full breakdown of local property taxes. The sales tax rate does not vary based on zip code. Has impacted many state nexus laws and sales tax collection requirements.

North Carolina State. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Historical County Sales and Use Tax Rates.

2020 rates included for use while preparing your income tax deduction. The average cumulative sales tax rate between all of them is 725. This includes the rates on the state county city and special levels.

Raleigh is located within Wake County North Carolina. The average cumulative sales tax rate in the state of North Carolina is 694. The minimum combined 2022 sales tax rate for Wake Forest North Carolina is.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County Restocking Free N95 Masks On Tuesday Wral Com

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Taxes Wake County Economic Development

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake Forest Map Town Of Wake Forest Nc

Wake County Nc Property Tax Calculator Smartasset

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

North Carolina Sales Tax Rates By City County 2022

March 2022 Carried Wake County Real Estate Median Price To Another Record High Of 430 000 Up 10k From February 2022 Wake County Government

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

Wake Commissioners Approve 1 7b 2023 Budget Including Tax Increase In Unanimous Vote Wral Com

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Homeowner Owners Could Be Pay More As Tax Hikes Are Proposed In Wake Raleigh Budgets Firefighters Rally For Pay Increase Abc11 Raleigh Durham

Wake Forest North Carolina Nc 27596 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More